Bank lending to SME property developers has almost halved since 2017 – but specialist alternative lenders can help fill the gap

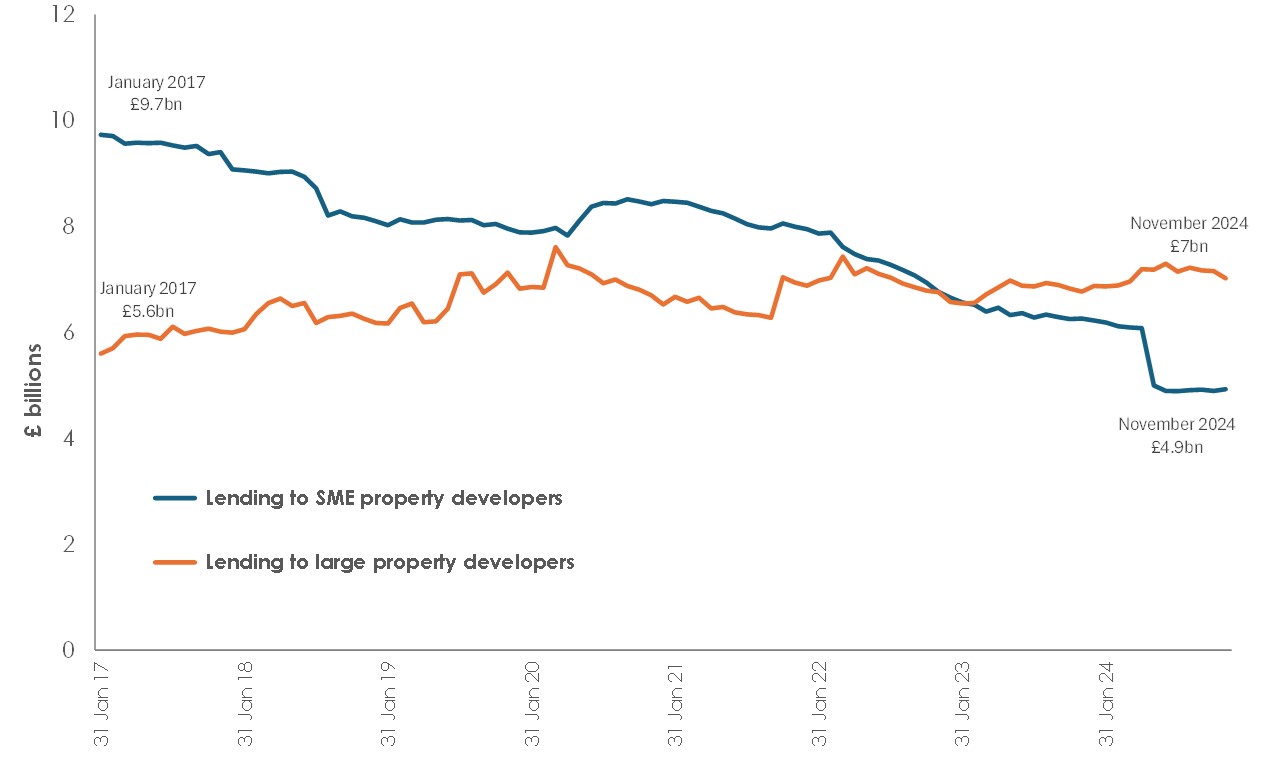

The value of outstanding loans by banks to SME property developers has fallen by 49% from £9.7bn in January 2017 to just £4.9bn* in November 2024 as banks pull back from lending to smaller housebuilders, says CapitalRise, a prime property development finance firm.

CapitalRise says that alternative lenders can play a critical role in supporting smaller property developments in the UK, with banks less able to provide finance to them. Banks have found it increasingly difficult to lend to property developers because of changes in regulations following the financial crash of 2008.

Banks have instead focused on increasing lending to the biggest property developers – the amount of outstanding lending to those businesses has increased by 25% over the same period, rising from £5.6bn to £7bn. This allows banks to lend in larger lot sizes and lower their costs, increasing overall returns.

Overall lending to property developers though has fallen by 22%, from £15.3bn to £11.9bn since January 2017. This fall in lending has evidently contributed to the shortage of new housing built in the UK over recent years. The Federation of Master Builders (FMB) says that, forty years ago, SME house builders used to deliver 40% of homes in the UK, but now only deliver 12%.

SME developers have traditionally played a key role in delivering new homes in the UK – especially on smaller sites in prime postcodes that may require specialist experience and highly-skilled workforces to deliver.

Uma Rajah, CEO of CapitalRise, says the business was set up specifically to address this ‘funding gap’ for smaller property developers, particularly in the luxury property sector where SME developers predominate.

Uma says: “Smaller property developers can’t rely on bank lending in the way that they used to. Following regulatory changes that came in the wake of the 2008 financial crisis, many of the traditional institutions have felt the need to step back. There is a real gap in financing for SME developers now.”

“In areas like prime property, small developers are critical to the market. Large developers tend to focus on major developments of hundreds of homes. Getting funding to those smaller, more bespoke developers is vital.”

“Our founders, as prime property developers themselves, had first-hand experience of being poorly served by the traditional incumbent lenders. This heritage means that the business possesses extensive experience and deep expertise in real estate development, especially within the prime property market. It also means we understand the needs of our borrowers, and can speak the same language.”

“CapitalRise was founded to offer cost-effective property financing that’s faster, simpler and more flexible than traditional sources of capital. Having lent against over £1 billion of prime property assets to date – and with a diverse and robust range of institutional funding lines to support quality borrowers in 2025 – we are fulfilling our mission to support this vital part of the property sector.”

*Based on Bank of England data

Please note: This article is not to be taken as an investment recommendation or advice. Investors are urged to seek independent professional advice when considering an investment. Investing places your capital at risk and you should diversify your investments.