Understanding the Capital Stack

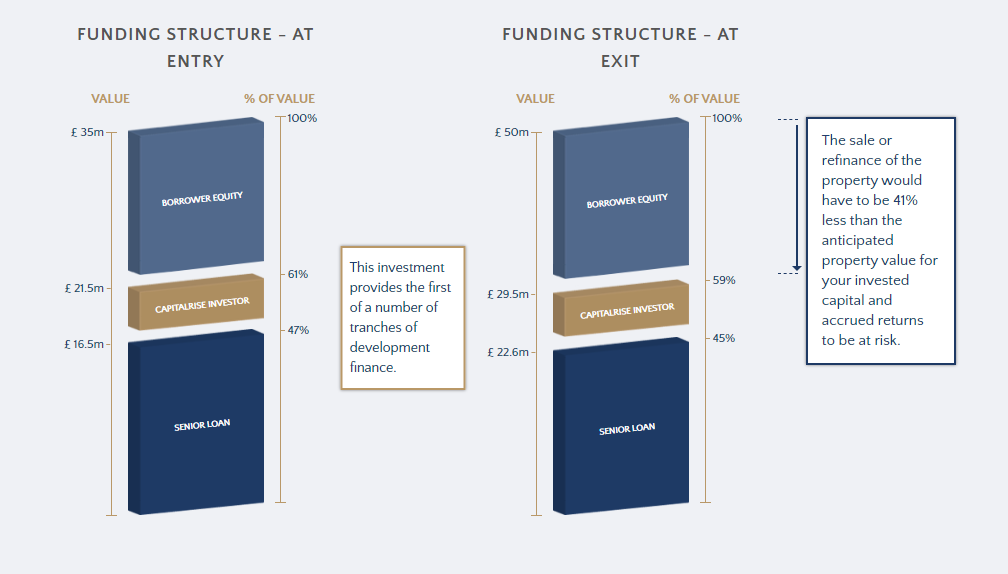

The capital stack visually represents the funding structure of a project, detailing:

- different sources of funding (debt and equity)

- the order in which each party will be repaid

- the amount and percentage of funding each party has contributed

Investors can use the capital stack as a tool to help evaluate and consider risk when investing in property development loans, as it illustrates where investors stand relative to other investors and their position in line to be repaid. (Please note, as is further explained in this post, the capital stack should not be an investor’s sole consideration when evaluating risk.)

The information displayed in the capital stack is also an important reference point for investors in a worst-case scenario. If a loan defaults or a borrower is unable to repay, capital will be repaid in the priority order set out in the capital stack. Capital invested at the top of the stack is highest risk as it is last due to be repaid, therefore it also offers the highest potential return. Lower-risk capital sits at the bottom of the stack, has a lower potential return and is always the first due for repayment.

CapitalRise provides three types of prime property funding: senior loans (or ‘senior debt’), mezzanine loans (also known as ‘junior debt’) and preferred equity. Investment in each type of loan offers a different risk and return profile to investors.

Senior loan

An investment in a senior loan is secured by way of a first legal charge over the property that the loan is provided against. When compared with other the other types of funding, a senior loan investment has a lower level of risk. In correlation with its risk level, it also therefore has the lowest potential return. It offers a lower level of risk because investors in a senior loan are due to be repaid before other investor types when a loan is redeemed – and in the event of a borrower being unable to repay their loan, the senior lender would act on behalf of investors and could reclaim their investment through enforcing the first legal charge security and forcing the sale of the property asset if necessary, in order to repay investors.

Mezzanine or junior loan

An investment in a mezzanine loan is secured by a second legal charge over the property, this ranks behind the senior lender’s first legal charge. This puts an investor in mezzanine debt second in line to be paid upon exit, after the senior loan is repaid in full. As this type of investment is repaid after a senior loan, an asset would need to be sold or refinanced at a certain value, to ensure that proceeds cover the total value of both the senior and mezzanine loans. If the proceeds of the asset sale only cover the senior loan amount, investors in the mezzanine loan will not have their invested capital returned to them.

Preferred Equity

Investing in preferred equity has the highest return potential of these three types of investment, but also comes with the highest risk. This type of investment is unsecured, with no legal charge over a property asset and preferred equity investors have the lowest priority (aside from the property developer’s own equity) when it comes to getting repaid. Investors in equity will only be paid after all investors in any senior and mezzanine loans have received their invested capital and return.

Please note the above descriptions apply to the potential investments offered through CapitalRise only, and do not refer to all investments that maybe available to an investor generally, and the risks and returns of other investments. Investors should consider any potential investment in loans as part of a diversified portfolio and should seek Independent Professional Advice before considering investing.

Understanding Loan to Value ratios

The capital stack is also used to illustrate the loan to value (LTV) of an investment. CapitalRise calculate LTV at the entry and exit of an investment, based on an independent, third party Red Book valuation.

LTV is another measure of risk as it helps an investor to understand the value of the loan in relation to the value of the actual asset being secured for first legal charge, and where applicable for second legal charge, both at the outset and at the exit of the loan. At CapitalRise, we lend against the loan to value at exit of an opportunity, as this includes not just the initial value of the loan, but also all interest payments and fees. Using this LTV ratio means that the total amount needed at the exit of a loan to repay investors capital and returns is included.

For example; an LTV at exit of 63% means that the property asset lent against would have to sell for at least 63% of its anticipated sales value in order to ensure that all investor funds and accrued return are repaid. Investors should check the underlying documentation for any investment they make as the LTV will differ from investment to investment.

Why is the capital stack important?

Overall, a capital stack can assist investors in assessing the perceived ‘risk and reward’ profile of a particular investment.

The capital stack also shows how much money the developer is physically contributing to a project, this is usually listed separately from investor equity as developer or borrower equity.

The level of equity that a developer is contributing to a project highlights to an investor the developer’s financial stake in the development project, which shows the vested interest the developer has in seeing the project to a successful conclusion, and that the developer is also risking some of their capital.

Thorough due diligence is key

Whilst the capital stack demonstrates to an investor the general risk profile of an investment, it does not stand alone as an assessment of overall risk. When completing your due diligence, make sure you have reviewed all the information on offer and asked the relevant questions to fill any gaps. It’s important to remember that the risk profile is different for every single investment and as an investor you need to check that it suits your risk appetite.