Research: UK bank account holders have £276bn earning zero interest – are they missing out on opportunities?

This research from CapitalRise was included in the Sunday Times article, ‘The £276 billion savings that are earning precisely nothing’. The full research findings are presented here.

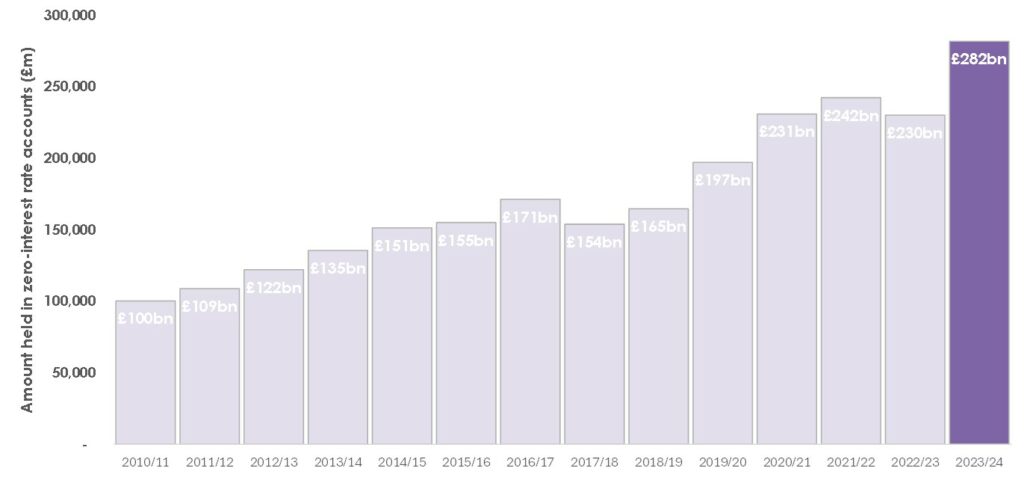

UK households kept a record £282bn in bank accounts that paid zero interest in November 2024.* This was a 22% jump on the £230bn earning zero interest a year ago (see graph below), according to research from CapitalRise, an Innovative Finance ISA provider offering prime property-backed investment opportunities. The current figure is some £276 billion held in zero-interest accounts, as of February 2025.

Those who keep funds in these accounts will in effect ‘lose’ around £5.6bn over the next year as inflation gradually erodes the value of these funds (based on inflation of 2.6%).

Consumers should consider whether they have the right allocation of money across different types of accounts. Savings accounts are designed to provide higher returns than current accounts typically in exchange for restricted access to your funds. Current accounts are ideal for everyday spending and bill payments, whilst they often offer zero interest. However, people have become accustomed to accepting this trade off in exchange for the ability to access their funds whenever they want.

Uma Rajah, Co-Founder and CEO of CapitalRise, says: “Consumers need to decide how they want to spread their money across the variety of different financial products available to them, taking into account the varying levels of risk, return and access to funds amongst other considerations. Placing too much money in zero-interest accounts isn’t going to help them grow their wealth, so this needs to be part of a carefully considered choice.”

Both current accounts and savings accounts, however, are protected up to £85,000 per person with UK-authorised institutions under the FSCS scheme, meaning that your money is likely to be safe even in the event that the bank should fail, making this a lower risk option.

Investment products offer much higher potential returns, reflecting their higher risk profiles. As with all investments, the consumer’s capital is at risk and the higher the risk profile of the investment the higher the return should be to reflect that. The FSCS scheme will not cover poor investment performance, so consumers should only be investing funds that they can afford to lose. They should also consider how long their funds will be invested for and how easily they can get them back if needed – as well as carefully considering the risk profile of the investment to ensure it suits their risk appetite and that they are happy with the potential return.

CapitalRise says that the increasing amount of money households have in bank accounts that yield nothing is surprising, but we should consider why we are seeing this. For instance, it may reflect the increased cost of living and the need for ready access to more money, or possibly that recent volatility has made people more cautious about locking funds away in savings or investment products. At times of uncertainty, it is natural that people may be less comfortable about locking their money away for a year or more (depending on the product), out of concern that they may need more cash at hand to cover future expenses – particularly unexpected ones.

Adds Uma Rajah: “Consumers need to keep some money in instant access current accounts, but you wouldn’t want more money than is necessary in an account that pays no interest.”

Amongst savers, those who have put their money in Cash ISAs are also getting a worse deal as there has been a sharp drop in the interest they offer. The average interest rate for Cash ISA deposits has fallen from 2.74% in 2023, to 1.8% at the end of 2024.**

“If a consumer wants to do more than just beat inflation and they are prepared to take some investment risk and consider sacrificing having instant access to these funds then they might want to carefully consider their risk appetite and look at a wider range of products offering potential rates above 5% p.a..”

For those with a higher risk tolerance, they can consider investing some of their capital into Innovative Finance ISAs (IFISAs). The IFISA is a tax wrapper for money invested in certain alternative investments – such as property development loans, as offered by CapitalRise – and investors can earn tax-free interest on these property-backed bonds. However, CapitalRise points out that the risks involved with an IFISA are clearly much higher than savings products, given factors such as the potential for default from the borrower.

This IFISA also offers opportunities for investors to assist in the acquisition of properties or refinancing of existing development loans. Uma concludes: “Customers can not currently expect their funds to grow significantly through Cash ISAs. The government’s decision to maintain the subscription limit for ISAs should encourage people to see how they can invest and save in the most tax-efficient way.”

*As of November 30, Bank of England